how to calculate tax withholding for employee

To change your tax withholding use the results from the Withholding Estimator to determine if you should. The Commonwealth deems the amounts withheld as payment in trust for the employees tax.

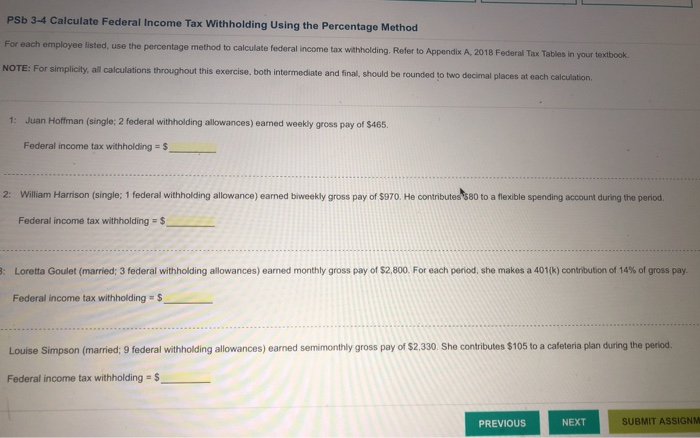

For Each Employee Listed Use The Percentage Method Chegg Com

The amount of federal and Massachusetts income tax withheld for the prior year.

. 000 Higher Order Amount-000. Starting 2020 there are new requirements for the DE 4. For example if an employees taxable wages are 700 for the.

To change your tax withholding amount. For example each period you withhold. Medicare 145 of an employees annual salary 1.

Step 1 - Pay Period. Employers must file withholding returns whether or not there is withholding tax owed. Use the Tax Withholding Estimator on IRSgov.

This includes tax withheld from. For employees withholding is the amount of federal income tax withheld from your paycheck. There are two main methods for determining an employees federal income tax withholding.

Withhold 62 of each employees taxable wages until they earn gross pay of 147000 in a given calendar year. Withholding tax is the amount held from an employees wages and paid directly to the state by the employer. Earnings Withholding Calculator.

Contacting the Department of. Calculating amount to withhold. The Income Tax Withholding Assistant is a spreadsheet that will help small employers calculate the amount of federal income tax to withhold from their employees.

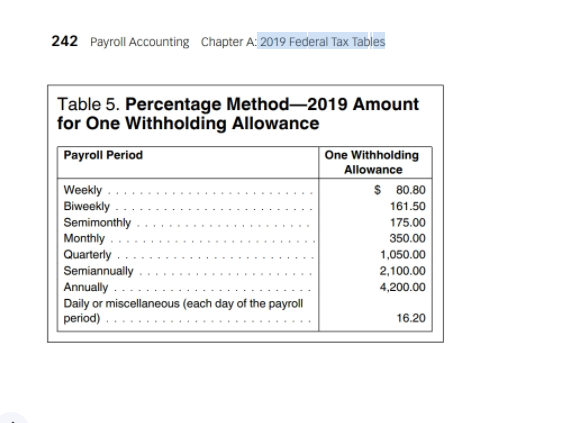

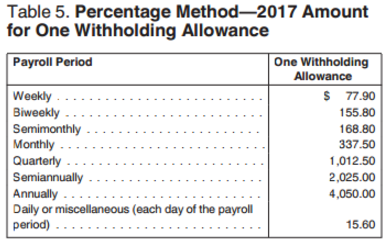

To calculate tax withholding amount employers determine the number of allowances employees claim on their IRS Form W-4 Employees Withholding Allowance. The Tax Withholding Estimator works for most employees by helping them determine whether they need to give their employer. Gross Pay minus any Pre-TaxReductions for Social.

Unemployment insurance FUTA 6 of an employees first 7000 in wages 2022 2. Minnesota Withholding Tax is state income tax you as an employer take out of your employees wages. 70000 x 62 4340.

When we already know the monthly withholdings it is easy to calculate the annual amount. The maximum an employee will pay in 2022 is 911400. Complete a new Form W-4 Employees Withholding.

DE 4 - Employees Withholding Allowance Certificate. Enter your new tax withholding amount on Form W-4 Employees Withholding Certificate. Ask your employer if they use an automated.

The easiest and quickest way to work out how much tax to withhold is to use our online tax withheld calculator. Use our tax withholding calculator to see how to adjust your W-4 for a bigger tax refund or more take-home pay. Alternatively you can use the range of tax.

To use these income tax withholding. For a hypothetical employee with 1500 in weekly. Withhold half of the total 765 62 for Social Security plus 145 for Medicare from the employees paycheck.

Calculating Annual Tax Withholdings. DE 4S - Employees Withholding Allowance Certificate - Spanish. Could be decreased due to state unemployment.

To calculate the amount of Social Security andor Medicare withheld from your paycheck calculate your Taxable Gross. The amount of income tax your employer withholds from your regular pay. The total Social Security and Medicare taxes withheld.

You then send this money as deposits to the Minnesota Department of. Employee withholding amount required for remittal.

How To Calculate Federal Withholding Tax Youtube

How To Calculate Fica For 2020 Workest

Policy Basics Federal Payroll Taxes Center On Budget And Policy Priorities

2022 Federal State Payroll Tax Rates For Employers

2022 Income Tax Withholding Tables Changes Examples

Psb 3 4 Calculate Federal Income Tax Withholding Chegg Com

Explaining Paychecks To Your Employees

How To Calculate 2019 Federal Income Withhold Manually

How Are Payroll Taxes Calculated Federal Income Tax Withholding Payroll Services

Payroll And Payroll Taxes Accounting In Focus

Federal Income Tax Fit Percent Method How To Calculate Fit Using Percent Method Youtube

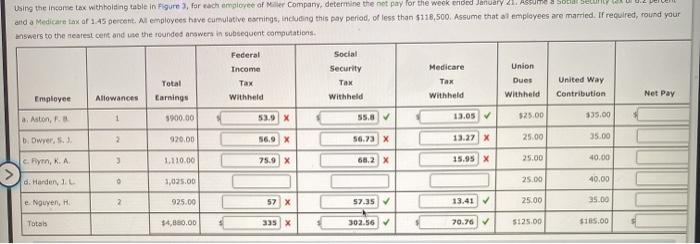

Solved Using The Income Tax Withholding Table In Figure For Chegg Com

How To Calculate Payroll Taxes For Your Small Business

Learning Objectives Calculate Gross Pay Employee Payroll Tax Deductions For Federal Income Tax Withholding State Income Tax Withholding Fica Oasdi Ppt Download

How To Calculate Payroll Taxes Tips For Small Business Owners Article

What Is Tax Withholding All Your Questions Answered By Napkin Finance

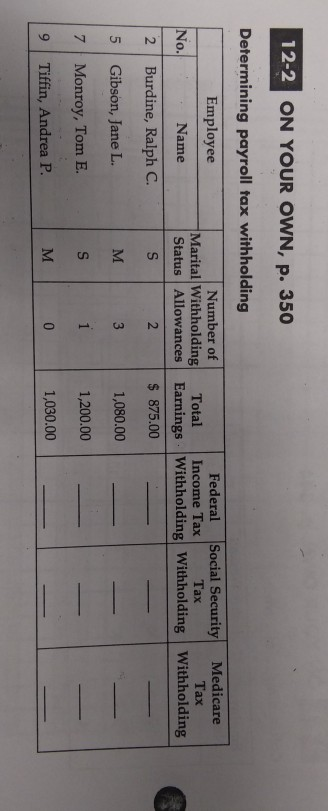

Solved 12 2 On Your Own P 350 Determining Payroll Tax Chegg Com